The biggest Japanese CtoC platform had another storming first half year to December.

It is expanding its network with new acquisitions, and continually adding new technology to attract more, and more diverse, customers.

SEE ALSO : Japan’s Zozo reports first annual profit drop

Mercari’s GMVs rose 45.3% to ¥228 billion in 1HQ2018 ending December. Active users per month rose 28.2% to 1.24 million and operating profit by 24.3% to ¥4.4 billion.

Mercari’s core user has so far been women in their 20s and 30s, but the CtoC platform is now working to attract middled aged men and women selling and buying higher ticket items. One way it is doing this is through acquisition; late last year it acquired the social media platform for car enthusiasts, Cartune, and integrated it with the Mercari ID system in February, making it easier for traders to profile each other.

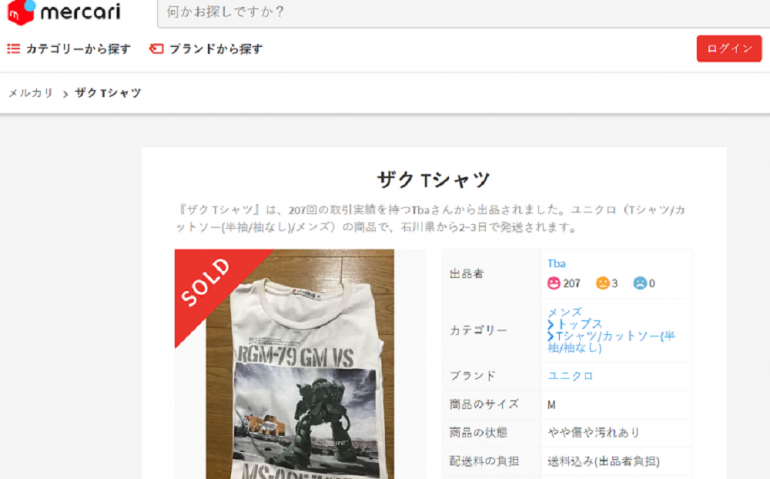

Meanwhile, Mercari continues to shave away barriers to buying and selling. It has already introduced AI technologies which identify items from photos for categories like phones and computers, but will shortly unveil a similar service for apparel – vendors will need to just take a photo and Mercari’s app will (theoretically) identify the product and complete all the product registration details.

In addition, following its ties with convenience stores to arrange one-scan drop offs for vendors’ packages, Mercari has now signed a deal with Japan Post that will see the roll out of Mercari-branded packaging corners across key post offices around the country. Vendors will be able to take their sold items to the local post office and then use packages and print out labels for free.

Mercari’s mobile payments service, Merpay, seems off to a solid start too. In the first 63 days since the launch in early February, 1 million users signed up. Merpay can be used in just under 1 million establishments.

SEE ALSO : Uniqlo Japan website hacked, 460K consumers affected

The US side of Mercari’s business remains the only blight in an otherwise impressive performance; losses came in at ¥3.6 billion during 1H2018.

Michael Causton is the co-founder and partner at JapanConsuming, a specialist research firm on Japanese retail and consumer markets. Founded in 2000, JapanConsuming has become the leading provider of insights on Japanese retailers and consumer trends to retailers, brands, government agencies and investors. As well as a highly regarded monthly report on the market to help subscribers keep up to date with the latest trends and data. JapanConsuming produces in-depth reports on retail sectors, seminars on key trends and consulting on market strategies and future trends.

Michael Causton is the co-founder and partner at JapanConsuming, a specialist research firm on Japanese retail and consumer markets. Founded in 2000, JapanConsuming has become the leading provider of insights on Japanese retailers and consumer trends to retailers, brands, government agencies and investors. As well as a highly regarded monthly report on the market to help subscribers keep up to date with the latest trends and data. JapanConsuming produces in-depth reports on retail sectors, seminars on key trends and consulting on market strategies and future trends.

(Source: JapanConsuming)