It is said that ‘marketplaces’ originated in Ancient Greece.

Being referred to as “Agora“ (pronounced Ah-go-RAH’), they had their origins back during 800 B.C.

SEE ALSO : Lazada expands Alibaba’s Taobao marketplace in Southeast Asia

From then until the mid-1990s, ‘marketplaces’ as a concept didn’t really change much

fundamentally – except for the likes of air-conditioned Department Stores and

Supermarkets, which made their way via the USA in the early-to-mid 1900s.

This was until the likes of Amazon, Flipkart and Alibaba changed the game towards the end of the 20th century.

Anyway, the purpose of this article is not to talk about how eCommerce has

revolutionized the 2,500-year old concept of “marketplaces”.

Rather, it is to showcase how in China, the 25-year old concept of eCommerce itself is being revolutionized.

Comparing USA and China – 2 of the largest eCommerce markets in the world: China is already ahead of the USA in terms of eCommerce Sales, and growing at a rate of 17.4% CAGR annually.

To add some more numbers in perspective, 11.11 (also known as “Singles’ Day in

To add some more numbers in perspective, 11.11 (also known as “Singles’ Day in

China) – similar to Black Friday (in the US) or Big Billion Day Sales (in India), the

comparison stands as follows:

- Alibaba (which owns TMALL and Taobao) posted sales of US$25.3 billion

(RMB168.2 billion) of gross merchandise volume (GMV) during Single’s Day - This translates roughly 2.5 times of the sales at Black Friday Cyber Monday

combined

For many top apparel retail brands in China today, anywhere between 40%- 80% of

their online sales come from TMALL, while the rest come from Taobao (also owned

by Alibaba), JD.com, and others – all of which are eCommerce Marketplaces.

So, clearly, strongly established marketplaces is not only a differentiator, but in many

ways also a driver of growth for Retail in China.

Clearly, China is dominating the global eCommerce landscape.

And given that Amazon is not even present here, what does the broader ecosystem look like, and what is going on from a consumer engagement standpoint?

Overview of the Chinese eCommerce ecosystem – “The walled gardens”

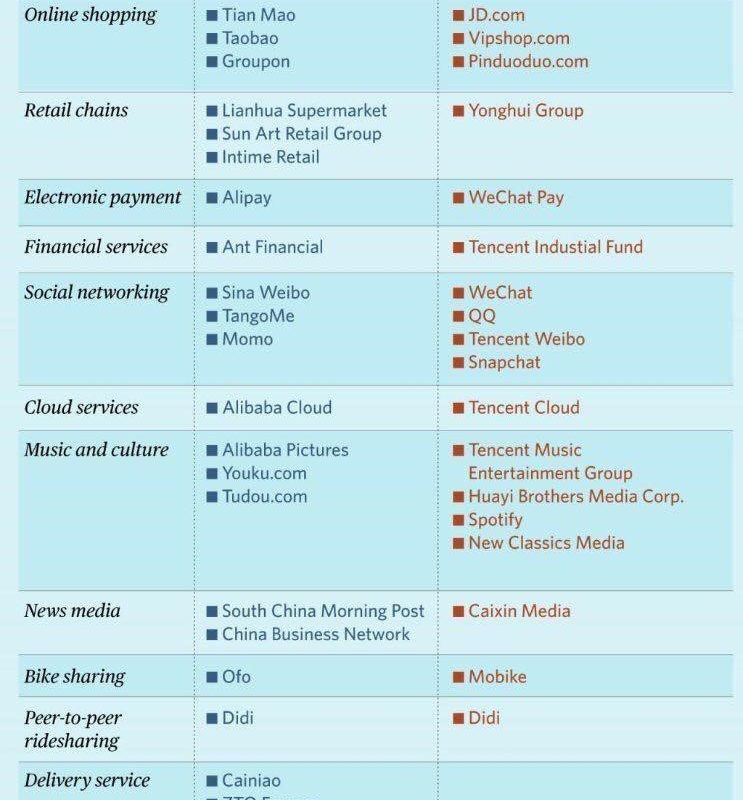

These 2 ecosystems are not really “eCommerce platforms”.

These 2 ecosystems are not really “eCommerce platforms”.

Rather they are fully grown ecosystem combining communication, entertainment, games, payments and of course, transactional commerce.

For instance, consumers seamlessly switch from Tencent’s WeChat messaging platforms where they see product recommendations, to transacting on JD (part of Tencent’ ecosystem).

At the same time, the same consumer might slip into clicking on an advertisement on

Youku (part of Alibaba ecosystem, often referred to as China’s Youtube), and end up

purchasing the product on TMALL.

On the mobile payment side, AliPay and WeChat Pay go head-to-head with market

shares of 54% and 40% respectively.

The larger share of Alibaba being easily attributed to online payments (via checkouts on TMALL and Taobao.com).

Looking outside of Commerce and payments, the 2 giants have invested in Cloud services (similar, although less mature application ecosystems compared to AWS), music and culture, news and gaming.

And even bike rentals (where 2 of the largest players Mobike and Ofo are affiliated with Tencent and Alipay, respectively).

It is therefore the complementarity within each ecosystem, as well as the “walled

gardens” that exist between them that drive competition. And in the end, it is the

consumer that chooses to benefit. Although, on many occasions this translates to

having friction on the consumer experience.

To give you a sense of the Chinese ecosystem across between the 2 giants (Tencent and Alibaba) and the smaller (but more significant on search – Baidu), see the figure below:

Data-driven Personalization and consumer engagement

A fundamental difference between Alibaba and Flipkart (and even Amazon), is

Alibaba’s willingness to open-up its platform to share consumer data with merchants.

By allowing brands to run “loyalty programs” within TMALL and Taobao, Alibaba has

opened up a “data marketplace” – where merchant brands can come together with

Alibaba and run engaging, gamified loyalty programs that help combine a consumer’s offline and online user journeys and experience.

According to PwC’s global consumer insights survey of 2018, Chinese consumers

are much more willing to share data and have high expectations that they will receive

personalized experiences because of it.

Alibaba is not complaining.

In fact in many ways it is only enabling brands to access more consumer data to build a stronger connect with its consumers.

So, why does Alibaba allow this sharing of data across TMALL?

The answer might lie in the fact that TMALL wants to retain its place as a destination for “product discovery”.

It wants to be the “Google (or in case of China, the “Baidu” of shopping). They want to retain the Search traffic.

The eventual sale might happen online or offline (and in either case, brands are enabled with data).

As we go move towards the end of the 20th century, newer models are evolving.

SEE ALSO : What to watch for at Alibaba’s ?

Checkouts are starting to happen within WeChat itself, and social-group-buying

models like Pinduoduo (China’s fastest growing Social eCommerce App) are gaining

ground. And they’re doing it FAST!

To put this in perspective:

- Alibaba’s Taobao took 5 years to get to 100 Billion RMB of GMV

- JD took 10 years to get to 100 Billion RMB of GMV

- Pinduoduo took a mere 2 years (yes, 2 years) to get to 100 Billion RMB of GMV

Things change FAST in China!

Amit Haralalk a is a marketing enthusiast and is an MBA from IIM Lucknow with specific interests in marketing and entrepreneurship. He currently works as the General Manager for Capillary’s operations in China.

a is a marketing enthusiast and is an MBA from IIM Lucknow with specific interests in marketing and entrepreneurship. He currently works as the General Manager for Capillary’s operations in China.

He has co-authored “The Fresh Brew: Chronicles of Business & Freedom”, a book chronicling the lives of 25 exemplary individuals. He started his writing escapades with TalkingTails.in – his personal blog.

(Source: Amit Haralalka)