Have you ever thought about the high turn over of stores in China? There are actually trends in the opening and closing of retail chain stores in Mainland China, and this article reports on those for the year 2017 and 2018.

Overall, there has been slight growth in the number of chain stores – but it is a volatile market and the large number of closures, (15% of stores each year) represents a significant impact into the profitability of brands and franchisees alike.

SEE ALSO : Fashion, China, and e-commerce: how do they all come together?

The study is the result of the process of tracking over 10,000 brands, and the focus in this article is on 1,400 brands where the published on-line store locators are regularly updated. Overall, there were 116,000 new store openings and 88,000 closures over the 2 years. This represents an average of 42 openings and 32 closures per brand each year. The total number of stores increased by 28,000 to a total of 331,000 stores. There was a similar pattern each year with around 58,000 stores opening (+20%) and a little over 40,000 stores closing (-15%).

F&B and Home & Appliance chains have seen the highest growth rates in store numbers

Fashion is by far the largest category. In this analysis, we have been tracking 529 brands with over 110,000 stores. Growth has been modest at 2.9% over two years, with both significant opening and closure numbers. The growth has come mainly from local brands such as Eichitoo (part of HLA group), Belle (shoes) and Balabala (kids brand, part of Semir group) all increasing by over 200 stores each year. The Bestseller Group from Denmark, with brands like Only, Jack & Jones, is one international fashion chain that is still expanding rapidly. But there is a larger list of international fashion retailers who have been struggling and have cut their store network, including Etam, Esprit, Nautica and E-Land Group from Korea.

The Sports market has generally been stronger than Fashion over the period, helped by the trend in athleisure wear as well as more of the Chinese population participating in sports activities. The total number of Sports stores increased by 8.6% over the two years, led by expansion from Nike, adidas and the leading Chinese brand Anta. Joma from Spain is a relative latecomer to the China market but has expanded rapidly in the last two years and now has over 200 stores. However, the Outdoor brands have been squeezed, with a net decrease in store count for the likes of Colombia, The North Face, Kailas and Jack Wolfskin.

The Food & Beverage and Home & Appliances sectors have seen the fastest expansion rates, with 18% and 35% respective growth over two years. For Home & Appliances, this has been led by consumer electronics brands like Oppo, Samsung and Suning. For F&B the expansion has been driven by fast food and cafes, with Starbucks, KFC, Discos and McDonalds all opening hundreds of new restaurants each year.

Luxury is the one category to see a net decline in stores. In 2017 the sector was still adjusting to the slowdown in trade as a result of the Chinese government’s clamp down on corruption – there was a 3.6% decline in Luxury store numbers. In 2018 there has been a return to modest growth of 0.6%.

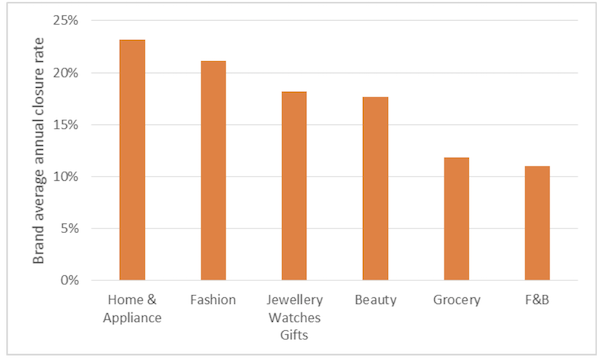

Unhealthy levels of closures are hitting many brands’ profitability

The closure rate of stores in China is very high, reflecting the volatility in the market. Across the brands tracked, over 15% of store networks are being closed each year. These numbers do not include brands moving to different locations in the same venue – something that can happen quite often in department stores as they reorganize their

floor plans.

A natural rate of store closures cannot be avoided, with retail venues doing major renovations or even closing permanently and brands being forced out. But a large proportion of closure are stores that were losing money for the brand or the franchise partner. A closure rate of around 10% per year would be considered reasonable for ‘natural attrition’. We see a similar closure rate in brands like adidas, Nike, McDonalds and KFC, where the brands are generally performing well and they have dedicated internal teams focusing on store location quality.

But for small box brands including the fashion category, retailers are closing at double this rate; around one fifth of their stores each year. As margins become tighter, the cost

of opening stores in the wrong location is having a big impact on business profitability.

In the past there were not enough good quality malls opening in China and the winning retailers were those able to move quickly and expand as the China middle class grew rapidly. But in the past 5+ years the dynamic has changed – there are now too many new retail venues opening, with mixed performance, and on-line shopping is taking a larger share of the consumer wallet moving past 20% in China.

Retailers need to be more strategic and selective in where they open – the full cost of opening a new store, including the fit out, local recruitment etc. runs into the hundreds of thousands of US dollars. Just reducing the number of failed new opening stores can have a massive impact on the brands overall profitability and success in China. This is why more brands are beginning to invest in strategic planning teams, and looking for the right data and market knowledge to help improve the success rate of new store

openings.

Currently the big winners in all this retail churn are the Real Estate agents and companies that do shop fit out, who are kept very busy.

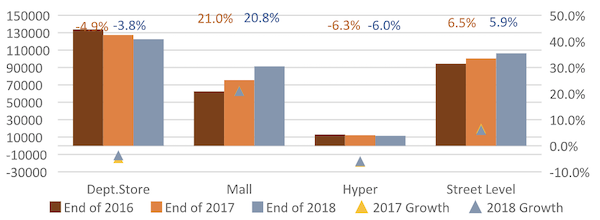

Chain stores growing in malls and at street level

Department stores remain the venue type with the largest number of chain stores, but has seen a 9% decline over the past two years. This is reflected in the number of department stores decreasing in the same period (see LocalGravity article on Retail Venue trends in China).

Malls have seen the strongest growth, with a 40% increase in Chain store numbers. This comes mainly from new mall openings, but also from malls upgrading and bringing in a

more Chain brands.

Hypermarket anchored malls have seen a decline in units leased to chain brands. This has been driven by closures of some of these venues, as the hypermarket model struggles with the rise of on-line grocery shopping and supermarkets.

Street level stores have seen steady growth in the last two years. This is driven by Chain retailers, especially Chinese brands, expanding in Lower Tier cities, where space in malls & department stores in still limited.

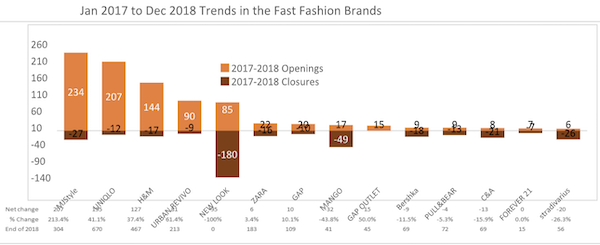

Fast Fashion brands showing different growth strategies in China

Looking specifically at the Fast Fashion chains, total numbers have grown by 25% to over 2,300 stores in the last 2 years. But the fortunes and expansion strategies have varied greatly.

MJ Style has been seen the most aggressive expansion. A relative late comer to the China market, it has tripled store numbers from 100 to 300 in the last two years. Uniqlo and H&M are the two established big players who have continued to open aggressively, and with limited closures.

In contrast Zara’s parent company Inditex, has been focusing on on-line sales and optimizing the existing stores network. New openings per brand are no more than 10 per year and the secondary brands of Bershka, Pull & Bear and Stradivarius have seen a decline in the number of stores.

New Look, having troubles back home in their native UK market, pulled out of China at the end of 2018. But just a year earlier in 2017, it was in expansion mode, opening 85 stores. US based Forever 21 has also announced the decision to exit the China market in April 2019, just 10 years after entering. C&A is another fast fashion chain who have had flat to negative growth.

Fast Fashion Brands Distributions by City Tiers

Generally, the Fast Fashion chains have focused on the major cities in China. 60% of all stores are located in the top 20 cities (Tier 1 & 2). For some of the international brands like Gap and C&A, this percentage is over 80%.

Chinese Fast Fashion brand MJStyle is breaking this dynamic. All their stores have opened in the last two years and the majority are in located Lower Tier Cities.

And the two brands with the largest network, Uniqlo and H&M are now opening in a broader mix of cities, with around half of their stores opening in the last 2 year being

outside the Top 20 cities.

SEE ALSO : The rise of malls: the changing retail landscape in China

LocalGravity has been tracking the openings and closures of retail venues and brand stores in China for the last 5 years. As a data provider and store network planning consultancy, LocalGravity collects and organizes the market data through a broad array of on-line sources, through on-site visits in the top 100 cities and through working closely with their leading international and domestic retail clients in China.

About the author:

Tom Brown is an experienced retail location planning professional, having worked for 15 years in Asia with Tesco and adidas. Tom set up the store location strategy teams for Tesco in China and South Korea. With adidas, China Tom managed the process of opening over 1,000 stores each year. In his time working in China, Tom has visited over 120 cities up and down the country. For the past 4 years at

LocalGravity, Tom oversees the client support and product development functions and provides consulting as a Retail Expert.

LocalGravity provides store network planning data, systems and best practice to retailers in Greater China and South East Asia. https://www.localgravity.com